schedule c tax form calculator

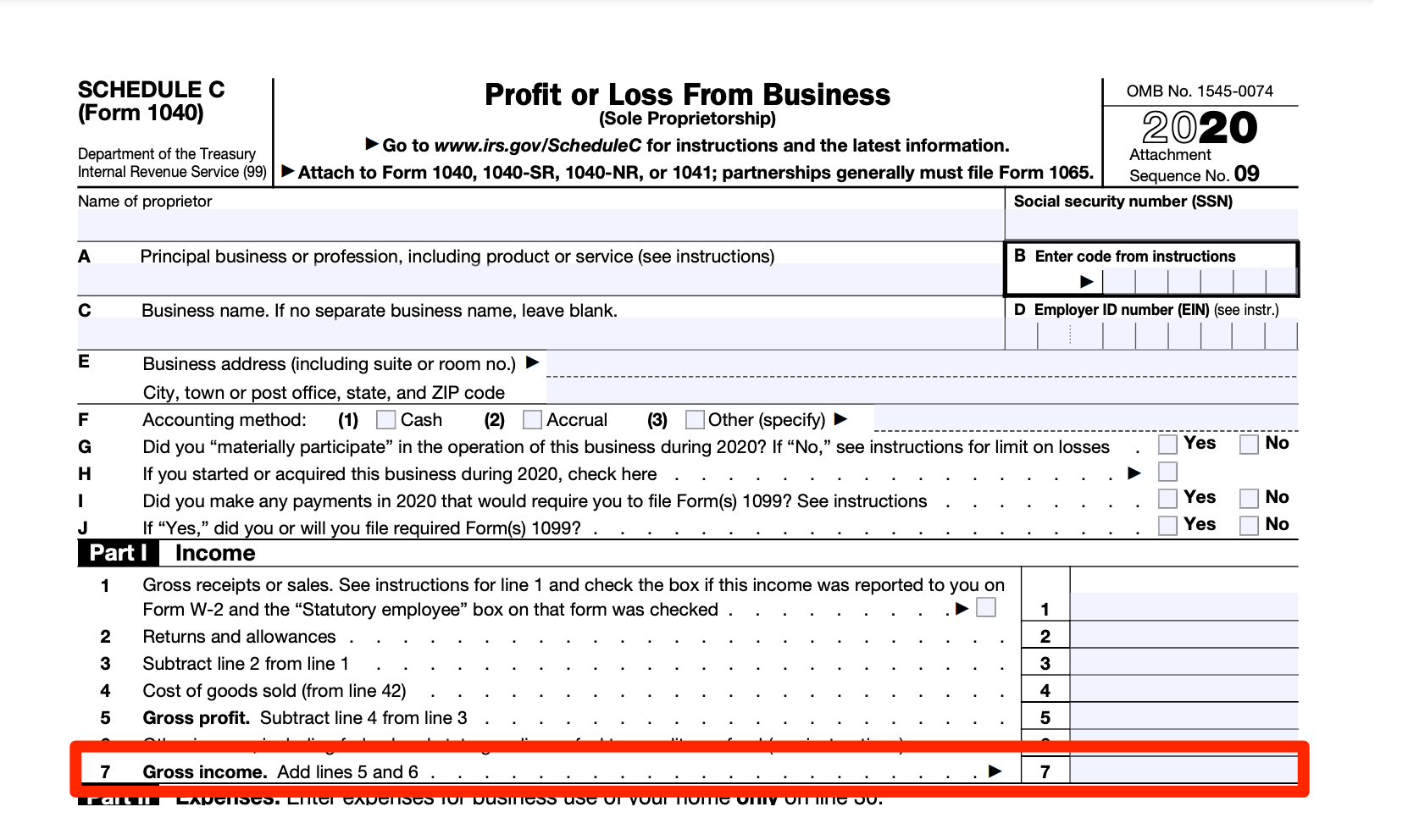

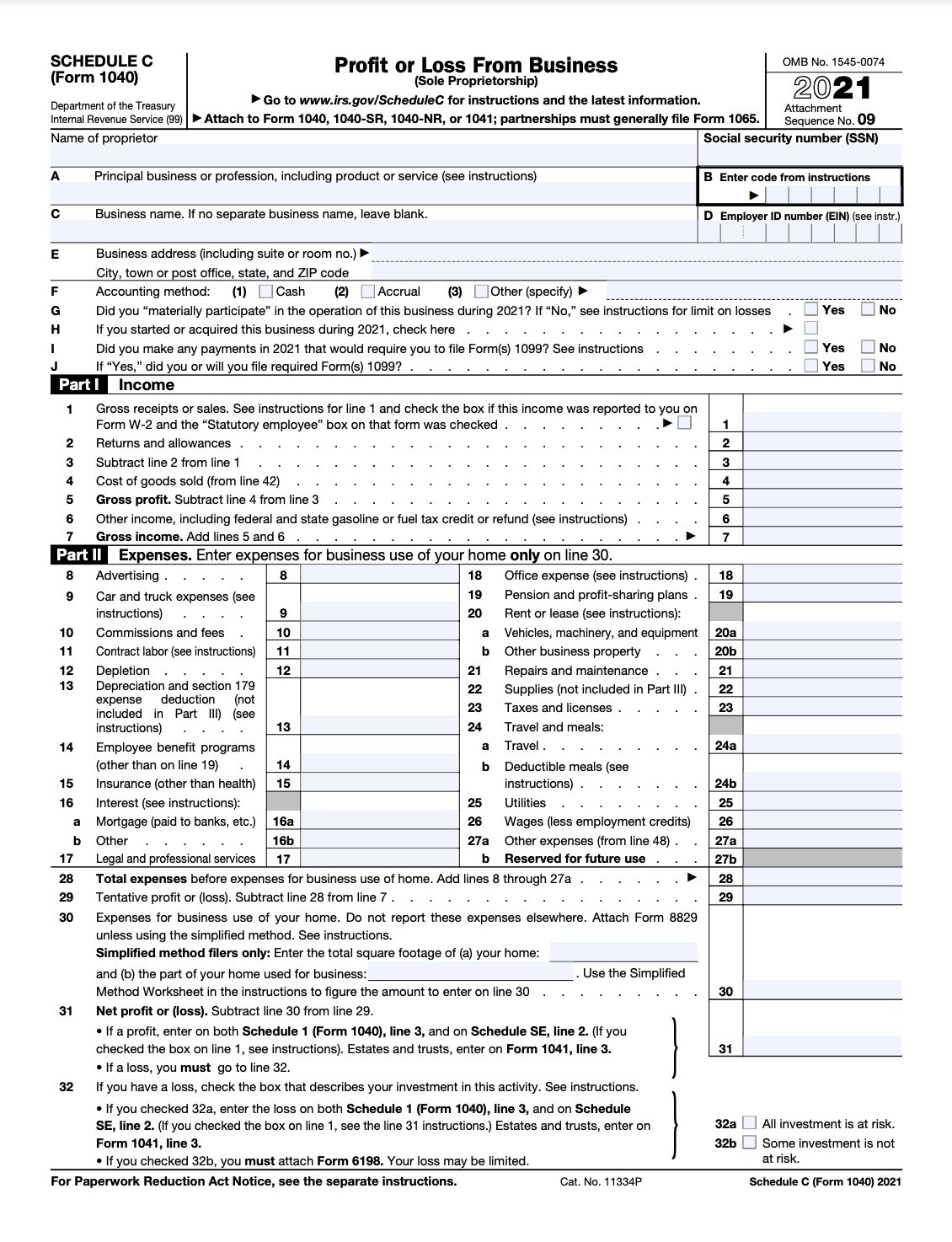

Form 1041 line 3. The first section of the Schedule C is reserved for your business information.

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

If you file using a software install our plug-in and well tell you the numbers you should enter at every step to prepare your taxes.

. Based on your projected withholdings for the year we can also estimate your tax refund or amount you may owe the IRS next April. The results are then transferred to Form 1040 and are used to calculate overall tax liability. Enter your filing status income deductions and credits and we will estimate your total taxes.

The Schedule SE is the part of Form 1040 where youll calculate your self-employment tax liability and pay the appropriate amount. Foreign Tax CreditThis is a non-refundable credit that reduces the double tax burden for taxpayers earning income outside the US. Name of proprietor.

Make tax season a breeze. If you file using a software install our plug-in and well tell you the numbers you should enter at every step to prepare your taxes. Schedule C is used by small business owners and professionals who operate as sole proprietors to calculate their profit or loss for the tax year.

Youll need detailed information about the sources of your business income. The child tax credit starts to phase out once the income reaches 200000 400000 for joint filers. A Schedule SE is a tax form that youll need to file if youre a freelancer paying self- employment tax.

Check out our Debt To Income Calculator to see the impact of qualifying income. And the taxes owed are calculated from there. Even if you use a tax preparer you must learn how to complete Schedule C to ensure the accuracy of your tax filing information.

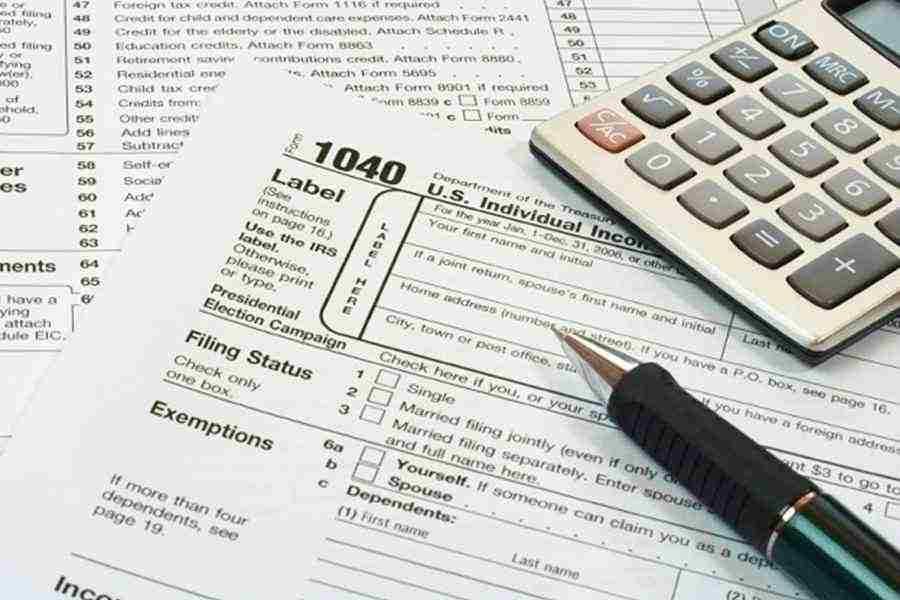

Your business accounting program should have this form. The form makes up part of Form 1040 which is the IRS tax return form for individual income tax. Online competitor data is extrapolated from press releases and SEC filings.

Go to line 32 31 32. Plan contributions for a self-employed individual are deducted on Form 1040 Schedule 1 on the line for self-employed SEP SIMPLE and qualified plans and not on the Schedule C. Its used to report profit or loss and to include this information in the owners personal tax returns for the year.

Schedule 1 Form 1040 line 3 and on. The Schedule C 1040 profit and loss from business sole proprietorship form is a tax form issued by the IRS to report the income and expenses related solely to self-employment activities. If you operate more than one sole proprietorship you must file a separate Schedule C for each one.

Information about Schedule C Form 1040 Profit or Loss from Business used to report income or loss from a business operated or profession practiced as a sole proprietor. The IRS Schedule C is used to calculate your business taxable profit for the tax year. Schedule SE line 2.

In most cases this will be your personal name. Child Tax CreditIt is possible to claim up to 2000 per child 1400 of which is refundable. That profit or loss is then entered on the owners Form 1040 individual tax return and on Schedule SE which is used to calculate the amount of tax owed on earnings from self-employment.

The BTC is designed for trading companies and it comes with commonly used schedules such as the capital allowance schedule. Self-Employed defined as a return with a Schedule CC-EZ tax form. If you have an LLC youre registered under you.

You can use the Tax Calculator to prepare your companys tax computation and work out the tax payable. See Line I later and the 2021 General Instructions for Certain Information Returns for details and other payments that may require you to file a Form 1099. If you checked 32a enter the loss on both.

If you checked the box on line 1 see the line 31 instructions. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e-filed or printed not including returns prepared through desktop software or FFA prepared returns 2020. For details see Pub.

As per income tax proclamation no 9792016 here are the business profit tax rates in Ethiopia. Un-corporate or individual businesses are taxed in accordance with the following schedule below. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole.

You will calculate the net profit or loss of a business based on the entries on Schedule C. Includes recent updates related forms and instructions on how to file. Include returns and allowances.

Its part of the individual tax return IRS form 1040. If you have a loss check the box that describes your investment in this activity. Use it to tell the government how much you made earnings how much you spent expenses and if that resulted in a profit or loss.

Corporate businesses are required to pay 30 flat rate of business income tax. Everyone who runs a business as a sole proprietor must fill out the 1040 Schedule C. Schedule C details all of the income and expenses incurred by your business and the resulting profit or loss is included on Schedule 1 of Form 1040.

A Schedule C-EZ is just a simplified easy version. If you have a tax advisor or accountant download the business tax reports they need to file your taxes Expense Report Profit Loss Schedule C etc. If you are filing Form C-S the companys tax computation and supporting schedules are not required to be submitted together with Form C.

Prepare a detailed Profit and Loss statement Net Income statement to give your tax preparer or to use in preparing your Schedule C. You can use the. The profit or loss is also used on Schedule E to.

In 2018 the last year reported more than 27 million small business owners filed their tax returns using Schedule C. Were going to review this in detail below. If you have a tax advisor or accountant download the business tax reports they need to file your taxes Profit Loss Statement Schedule C etc.

The profit is then reported on your own 1040 Form. A Schedule C is a tax form filed with your personal tax return that helps you calculate the profit or loss from your business. Once a year you will need to file the Schedule C Form and you can.

Below is an example of how income is calculated for Sole Proprietors filing on the Schedule C of a tax return. If you received cash of more than 10000 in one or more related transactions in your trade or business you may have to file Form 8300. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to.

Please note that this is an over-simplification of the process and shouldnt be used as tax advice or as a way of suggesting how to qualify for a home loan. Make tax season a breeze. If a loss you.

Schedule C is an important tax form for sole proprietors and other self-employed business owners. If you made the deduction on Schedule C or made and deducted more than your allowed plan contribution for yourself you must amend your Form 1040 tax return and. How to fill out Schedule C.

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your 2021 Schedule C With Example

A Complete Guide To Filing Taxes As A Photographer

How To Fill Out Your 2021 Schedule C With Example

Free 9 Sample Schedule C Forms In Pdf Ms Word

Irs Crypto Tax Forms 1040 8949 Koinly

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

Schedule C Instructions With Faqs

Schedule C Instructions Easy Step By Step Help

How To Calculate Gross Income For The Ppp Bench Accounting

What Is A Schedule C Tax Form H R Block

Should I File With Schedule C Ez Shared Economy Tax

Free 9 Sample Schedule C Forms In Pdf Ms Word

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

![]()

Schedule C Instructions How To Fill Out Form 1040 Excel Capital

Free 9 Sample Schedule C Forms In Pdf Ms Word

How To Fill Out Your 2021 Schedule C With Example