city of richmond property tax inquiry

Property Tax Vehicle Real Estate Tax. City Of Richmond Real Estate Tax Inquiry.

Due Dates and Penalties for Property Tax.

. Do not enter information in all the fields. For property tax payments include the 9-digit Folio Number located the top of the Property Tax Notice. The results of a successful search will provide the user with information including assessment details land data service information planning and governmental specifics.

Property Taxes Due 2021 property tax bills were due as of November 15 2021. The propertys Parcel ID should be entered such as W0210213002. Property tax inquiry richmond.

The city of Richmond is authorized by state law to levy taxes on real property in the city of Richmond. Disabled Veterans or their surviving spouses who believe they may be eligible for the real estate tax. Use this form to report non-emergency concerns regarding your property services and utilities or problems in your neighbourhood like street lights out or pot holes.

The general portion is used for general government purposes the parks portion is used to fund the establishment and. Order Tax Certificates Tax Certificates are conveniently available online through. Property Inquiry The report will include.

Real Estate and Personal Property Taxes Online Payment. Richmond City Assessors Office 900 E. Finance Taxes Budgets.

Informal Formal Richmond City Council Meetings - July 25 2022 at 400 pm. To contact City of Richmond Customer Service please call 804-646-7000 or 3-1-1. 1Search Any Address 2Find Property Records Deeds Mortgage Much More.

Search property by name address parcel ID. For example entering W0210213 will display the list of all Parcel IDs starting with. This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc.

Enter the Address Here. Understanding Your Tax Bill. Electronic Check ACHEFT 095.

Monday - Friday 8am - 5pm. 815 am to 500 pm Monday to Friday. Personal Property Taxes are billed once a year with a December 5 th due date.

To pay your 2018 and prior City delinquent taxes online visit the following website. For example entering W0210213 will display the list of all Parcel IDs starting with. Richmond BC V6Y 2C1 Include your account information on the cheque.

In case of an emergency call the City of Richmond 24 Hour Call Centre at 604-244-1262. The Personal Property tax rate for 2021 is 4 per 100 of assessed value. City of Richmond Tax Department 6911 No.

Tax maps also known as assessment maps property maps or parcel maps are a graphic representation of real property showing and defining individual property boundaries in relationship to. This information helps the City identify which property to apply the payment to. Please feel free to call us at 281-341-3710 or email us at FBCTaxInfofortbendcountytxgov with any auto or property tax questions.

Assessed value of the property. Search by Parcel IDMap Reference Number. City of richmond property tax inquiry.

Manage Your Tax Account. Broad Street Richmond VA 23219. Search by Parcel ID Parcel ID also known as Parcel Number.

In case of an emergency call the City of Richmond 24 Hour Call Centre at 604-244-1262. Broad St Room 107 Richmond VA 23219 USA Fax. Ad View current and past property tax rates and liens on any property.

Search results may be exported to a PDF an Excel Spreadsheet or a Word Document. Personal Property Taxes are billed once a year with a December 5 th. Choose a search option from the first drop down box below and follow search instructions as noted.

My Property Account is an online profile that gives you secure access to information regarding your City of Richmond accounts such as Utility Billing Dog Licences and Property Taxes - 24. Obtain a free uncertified Property Report on any Richmond property. View the Full Range of County Assessor Records on Any Local Property.

All City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to paying 2019 or newer property taxes to the Ray County Collector. The propertys Parcel ID should be entered such as W0210213002. City of Richmond Parcel Tax Search.

Search by Parcel IDMap Reference Number. Your annual property taxes collected by the City of Richmond funds municipal services and other taxing agencies such as the Province of BC School Tax TransLink BC Assessment Authority Metro Vancouver and the Municipal Finance Authority. This utility allows a person to interactively search for City of Richmond real estate tax information based on Parcel ID or Address.

3 Road Richmond British Columbia V6Y 2C1. Partial Parcel ID may be entered but at least 8 digits should be entered in order to activate the auto suggestion. The results of a successful search will include the outstanding tax penalty and interest owed for a property.

Visit our Property Inquiry application. Revised Public Information Advisory - Special Council Meeting on July 5 2022 at 500 pm. Property values are determined by the City Assessor and the Department of Finance issues the tax bills based on the valuation information provided by the Assessors Office.

See Property Records. 295 with a minimum of 100. Learn more about a new identity for our growing city.

The City of Richmond is authorized by state law to levy taxes on real property in the city of Richmond. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. Property Information Search Portal.

Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp. Due Dates and Penalties for Property Tax. To pay your 2018 and prior City delinquent taxes online visit the following website.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Ad Search Property Tax Records from Home Without Lines or Paperwork. Report a Problem Request a Service.

View your tax bill. Click here to pay your personal property tax online by August 5. Personal Property Registration Form An ANNUAL filing is required on all personal.

3 Road Richmond British Columbia V6Y 2C1 Hours. Gross taxes levied. Partial Parcel ID may be entered but at least 8 digits should be entered in order to activate the auto suggestion.

Use our online database of US properties to assess get an instant valuation on any home. These agencies provide their required tax rates and the City collects the taxes on their behalf. Other Services Adopt a pet.

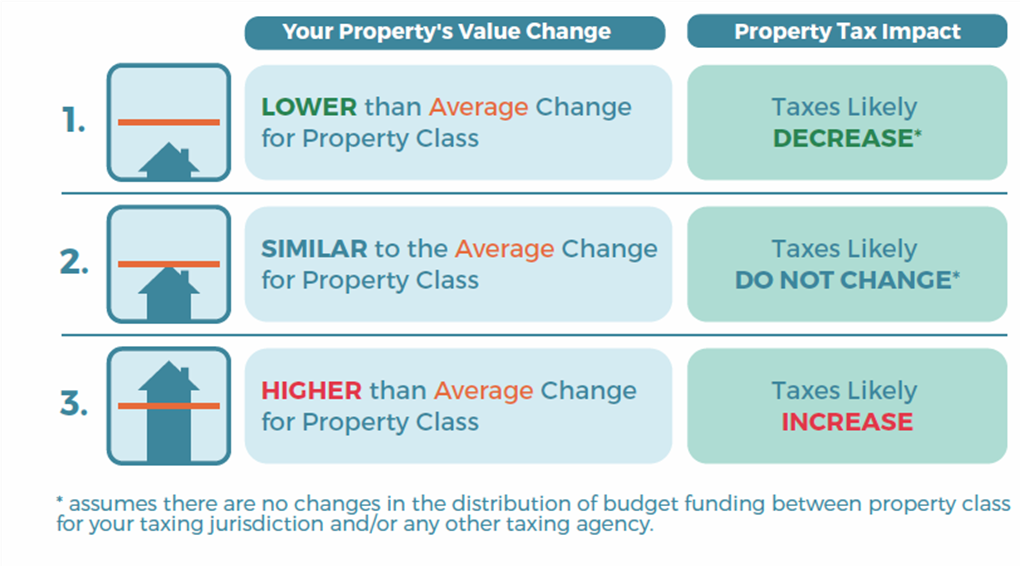

Property Assessments City Of Terrace

Azalea Mall Richmond Virginia Richmond Mall

Ontario Cities With The Highest Lowest Property Tax Rates October 2022 Nesto Ca

Northern Bc Region Property Assessments

Lower Mainland 2022 Property Assessments In The Mail

Paying Your Property Tax City Of Terrace

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Property Tax Billings City Of Richmond Hill

Richmond Property Tax 2021 Calculator Rates Wowa Ca

276 Bass Street Real Estate Trends Real Estate Tips Sight Sound

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now